Overview of the tax system:

- Tax rates are progressive and increase with income.

- For employees, taxes are deducted at source at a pre-determined rate.

- Taxpayers must file a tax return detailing their income and deductions each year by April 30.

- Numerous tax measures make it possible to considerably reduce the amount of taxes payable, particularly for families.

- There is no federal or provincial estate tax.

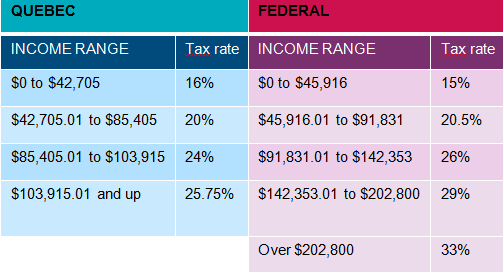

Here are the tax rates for 2017:

A Québec abatement equal to 16.5% of the basic federal tax applies.

Presented by

Jean-François Coutu – CPA, CA, LL.M. Fisc., Associate Partner, Canadian Tax Leader Mazars

00